“Government of the people, by the people, and for the people”

2020 Survey on Palos Verdes Estates Police for the Upcoming City Councilmember Election

Poll closed on September 3, 2020

PVrrg conducted this confidential survey with two objectives:

To help explore resident perceptions on one of the most important issues identified in our July 2020 Issues Poll (click here) — Long-term Financial Viability of PVE given our large and growing unfunded Pension Liability and the role of our Police Department cost in that

To give the community a voice by which they can help influence the upcoming election of two City Councilmembers in November 2020

For the full 70-page Report on the survey, Click here

Results

190 residents of Palos Verdes Estates took the survey:

Respondents represented a diversity of opinions, including people who voted both “yes” and “no” on Measure E:

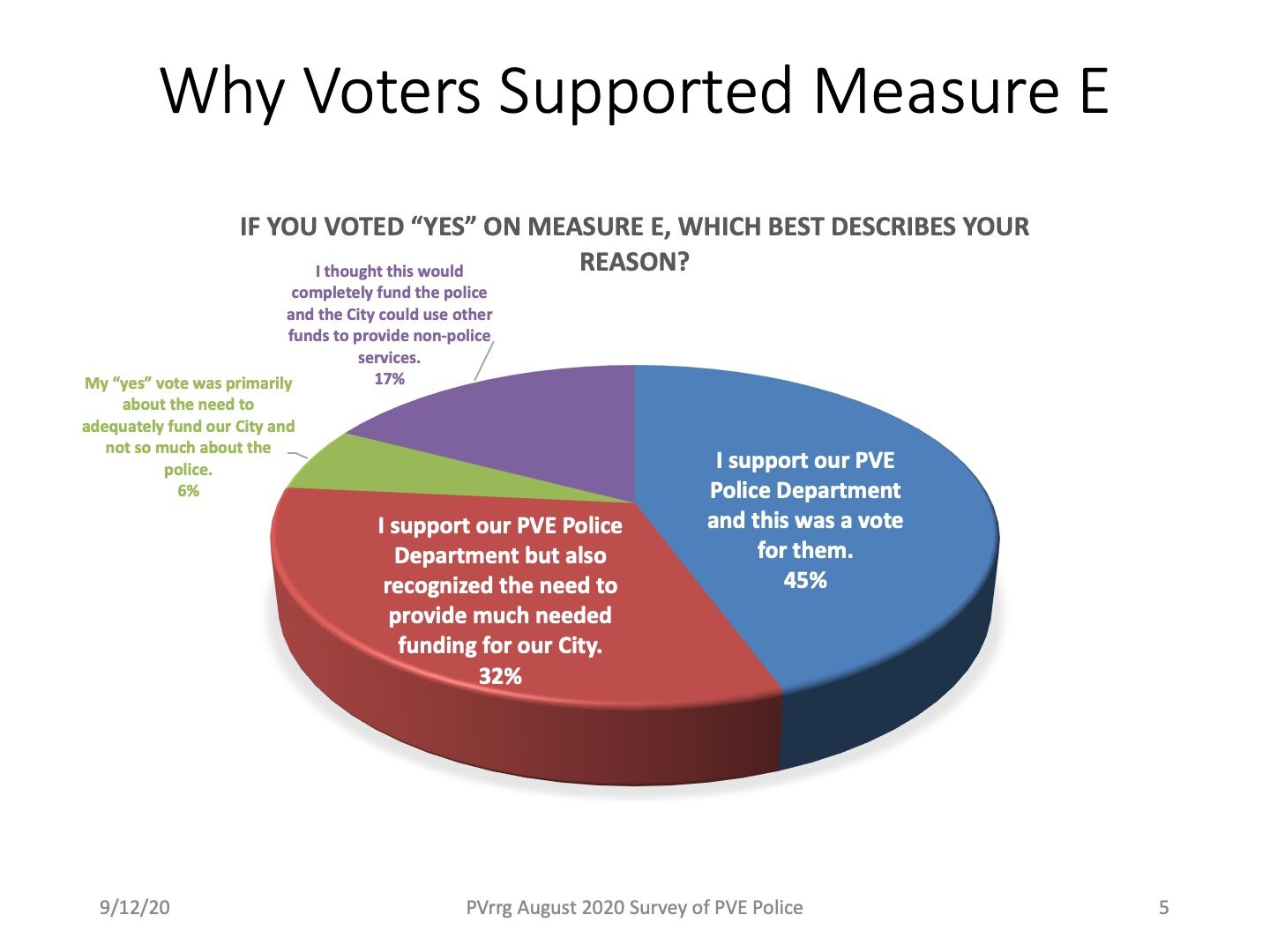

Residents who vote “Yes” on Measure E were asked for the reason why they did so:

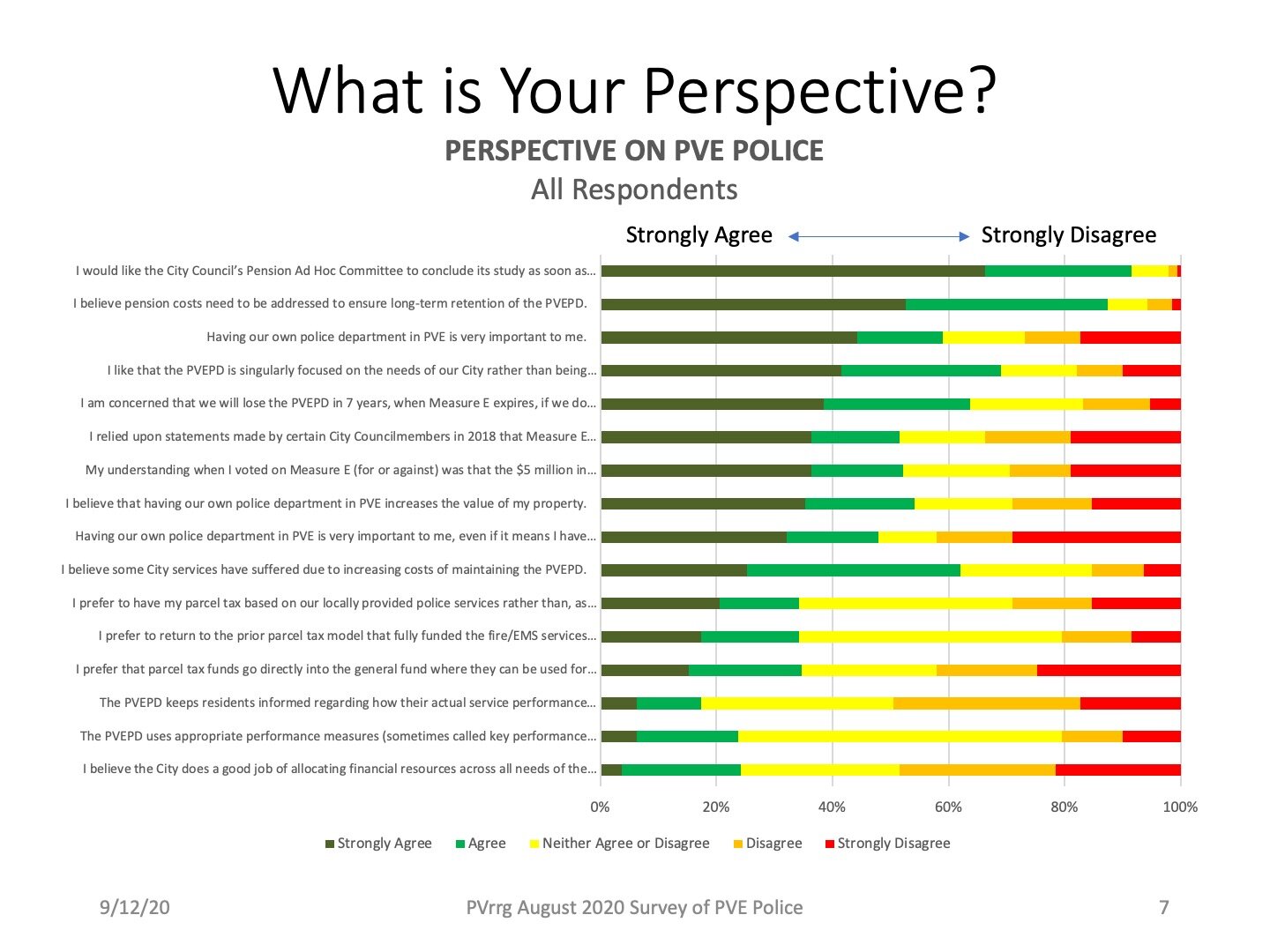

Respondents were asked for their perspectives, and the degree the agreed or disagreed with the following statements:

Here is a summary of the responses:

For each specific question, the full report has a breakdown by demographic:

Respondents were asked for their perspectives on different alternative Policing model:

Respondents were asked about their satisfaction with Police service levels on various dimensions:

Respondents were asked about the value they perceive in a local Police Department relative to outsourcing:

Answers to the value question varied across demographics:

Respondents were asked how much more they are willing to pay in order to retain our local Police Department:

Again, the responses varied by demographic:

The Full Report also contains 15 pages of a wide spectrum of freeform comments by the respondents expressing their perspectives on this topic, so PVrrg encourages you to read them.

For the full Report on the survey, Click here

Background

Due to the limits Proposition 13 imposed on property taxes in 1978, PVE was faced with a revenue shortfall. To offset the shortfall, the City passed a parcel tax in 1980. This initial tax was earmarked for the PVE Fire Department, at that time a local agency. Although the City had disbanded its Fire Department in 1986 and contracted with LA County to provide both fire and emergency medical services (paramedics or EMS), residents voted to renew the parcel tax 4 times after 1980: in 1991, 1996, 2001 (when EMS was added to fire) and 2006.

An effort to renew the parcel tax once again, in 2017, was defeated when voters rejected Measure D by a vote of 61.2% in favor and 38.8% against, thus falling short of the supermajority (two-thirds) required for passage. Measure D was technically another tax to support fire and EMS but was promoted by some as a means to provide (indirect) support to the PVEPD. Failure of Measure D created a $5 million hole in the City’s budget for the fiscal year ended June 30, 2018 (FY 2017-2018).

In 2018, PVE residents passed a new parcel tax, Measure E, by a vote of 69 % to 31%. The tax assessment rate was $342 per lot, plus $0.20 per square foot of building improvements, for nine years starting in FY 2018-2019. Unlike the earlier versions, this new parcel tax was directly tied to funding the internal PVEPD and could not be used to pay for any other City expenses. Measure E provided for a flat tax for 9 years, beginning in FY 2018-2019 and continuing through FY 2026-2027.

Many residents who voted for Measure E believed this new tax would raise sufficient funds to cover the full cost of running the PVEPD. This misconception was no doubt partly due to the fact that the prior parcel taxes had, in fact, covered the full cost of fire and (after 2001) EMS.

Annual revenues generated by the Measure E parcel tax are just under $5M per year. The Measure did not contain any provision for inflation, such as an annual increase tied to the CPI (Consumer Price Index), so this amount will remain relatively constant over the 9 years. The actual cost of running the PVEPD was $6.6 million in FY 2018-2019 as reported by the City during its annual budget review. In FY 2019-2020, the cost is projected to be $7.1 million. The amount currently budgeted for FY 2020-2021 is $7 million.

What is the True Fully Loaded Cost of the PVEPD?

There has been some discussion in the community to the effect that the costs reported by the City do not reflect the “fully loaded”costs of the PVEPD. While there are some additional expenses related to the PVEPD that are not included in the above numbers, there are also expenses that are not, strictly speaking, related to “core” police functions and that should be subtracted to determine the actual costs. Finally, there are costs often perceived by members of the community as belonging to the PVEPD that may not appropriately be included in the “fully loaded” cost calculation.

Additions to Reported PVEPD Costs

For the past several years, the City has elected to pay only the minimum annual amount required by CalPERS for its pension obligations. The shortfall is not reported as a current period expense but is added to our pension debt, known as unfunded accrued liability (UAL), and is recorded on the City’s balance sheet. “Short-payments” of annual pension expenses earned in the current fiscal year by active PVEPD employees (Normal Costs,) should be added to departmental expense in the “fully loaded” cost calculation. According to the most recent CalPERS valuation reports, the UAL balance was $16.6M at June 30, 2018 and is now estimated (through GovInvest) to be over $19 million. UAL is a debt that the City will eventually have to pay along with interest (at the rate of about 7%); about 3/4 of this liability relates to PVE PD’s sworn officers.

Certain costs incurred by the City are shared, or “allocated” among departments in the City’s financial reports. Various methods are used to spread these costs, such as by headcount, payroll dollars or square feet of building occupancy. As a result, reported costs do not precisely reflect the actual amounts incurred specifically by each department, including the PVEPD. Some of this does not have a material effect on the accuracy of the numbers reported and/or the difficulty of obtaining the information outweighs any value additional precision might bring.

Insurance expense directly attributable to the PVEPD, both Workers Compensation and Liability, should be used to determine the actual cost of the PVEPD. These numbers are already available from the insurance provider (JPIA). Any differences between reported amounts and actual amounts charged by JPIA should be added to, or subtracted from, reported insurance costs to determine the “fully loaded” number.

Other expenses which, like insurance, are allocated among departments may or may not accurately represent the cost attributable to the PVEPD. Computer maintenance is one example, budgeted to be $75K in the current fiscal year. Other than insurance, the amounts are likely not significant.

Purchases of police vehicles have typically come out of the “Equipment Replacement Fund.” In years past, each department contributed part of its budget to this fund in anticipation of equipment that would need to be purchased in the current or future years. As such, equipment purchases did not show up in the departmental expense reports. Funds for equipment needs were simply transferred out of the General Fund to cover the anticipated cost. For FY 2020-2021 $116K has been budgeted for police vehicles. This amount, or at least the depreciation cost of the vehicles, should be added to obtain the “fully loaded” cost.

Subtractions from Reported PVEPD Costs

PVE Cares, Community Support, Emergency Preparedness, Animal Control, Peafowl Management are all “non-core” services provided by the PVEPD that should be subtracted, as discussed above, from the reported departmental expense in order to determine “fully loaded” cost. Approximately $200K has been budgeted for these costs in FY 2020-2021. PVE would need to continue to pay for these cost after outsourcing (if the decision were to retain these services).

UAL Related Costs - Not Includable in the “Fully Loaded” Amount

Interest and payments due on the City’s “Unfunded Accrued Liability” (UAL), are among expenses NOT reported by the City as periodic departmental expenses. In addition to “short paying” the annual Normal Cost incurred for active employees, the City has also been paying only the minimum amounts required by CalPERS for principal and interest on the UAL for several years.

Some residents are under the impression that these “short-payments” and the resulting growth in the UAL, are a direct cost of maintaining the PVEPD. This is a misconception. Rather, the choice to pay only the amounts required by CalPERS each year, rather than the full cost incurred annually, is a decision by City management independent of the police. This is a financing decision, similar to paying the minimum amount due on a credit card, with unfortunately similar results.

Most of the City’s pension expense is related to retired employees who no longer contribute to the plans but draw benefits. Of the roughly 100 participants in the most expensive plan (Classic Safety), only 20 are active employees. The amount attributable to retired employees is an ongoing cost and cannot be eliminated by outsourcing police services.

The ratio of active to retired employees is one of many factors contributing to growth of the UAL. Changes in actuarial assumptions, variances between actual results and actuarial assumptions and failure of CalPERS to achieve its investment targets are all partly responsible for the increasing pension debt burden.

Conclusion:

There are a few refinements that can be made in evaluating the exact annual cost of maintaining the PVEPD. In our opinion, departmental expenses reported by the City for the PVEPD are a reasonably good estimate of its “full cost.” Annual revenues from the Measure E tax, however, are roughly $2 million less than annual expenses. Even if substantial cost savings are found, the remaining costs will continue to increase with inflation.

For further information on Measure E and the Police Department relative to other cities, click here.

Here are links to previous surveys/polls conducted:

2020 PVE Police Survey — click here

2020 PVE Issues and Priorities — click here

2018 Measure E — click here

2017 Measure D — click here

2017 PVHA Board Election — click here

2017 Malaga Cove Homeowners — click here